If you want to sell anything from your WordPress website, whether a physical product, a digital download or a membership, then you need to be able to take payments from your customers. To do this you will most likely need a payment gateway. In this post, we’ll give ten tips to help you choose the gateway which is right for your WordPress site.

- Understand why you need a payment gateway

When you sell something online, there needs to be a way of transferring money from your customer’s account to yours. This is normally done using a payment gateway: a third-party tool that allows customers to submit payment information via your website, authorises the payment, and instructs the customer’s bank to transfer the money.

Payment gateways offer online sellers a number of benefits. It makes selling quick, ensures that transactions follow PCI DSS compliance and gives your customer a choice of payment methods. - Understand the cost implications

Payment gateways charge for their services and often this includes a fee for each transaction. PayPal, for example, charges 2.9% plus $0.30 USD of the amount you receive. When you are working on tight margins, 2.9% can put a sizeable dent in your profits, so it is worth searching for a competitive provider. You may need to adjust your pricing once you take these fees into account. - Is an on-site or off-site gateway better for your business?

Some gateway providers enable you to place the payment gateway directly on your website whilst others require the customer to temporarily leave your site whilst the transaction takes place.

There are pros and cons to both these. When the gateway is on your site it makes the payment process much smoother for the customer. However, if the payment takes place away from your site, the responsibility for the security of the transaction lies with the gateway provider. This takes away some of the compliance regulations that online traders can be burdened with. - Consider getting a merchant account

Most business bank accounts will let you pay in money by cash, cheque, direct debit or transfer. If you want to accept money from credit cards or debit cards, some payment gateway companies require you to have a separate merchant account into which the money is paid.

From a financial perspective, having a merchant account can be a shrewd move because payment gateways which deposit funds directly into your business bank account usually have higher processing fees than those that require a merchant account. Many payment gateway companies, unsurprisingly, offer merchant account services. - If you take payments, you need a secure site

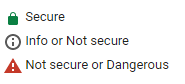

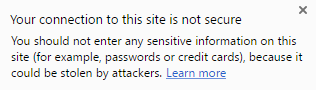

To safeguard its users, Google now informs visitors how safe a website is. It does this by displaying icons at the beginning of the Chrome address bar.

If your website does not display the green padlock icon, visitors may think twice about buying from you. Even if you are in the Info or Not Secure category, the warning from Google is clear:

To attain that green padlock and inspire trust in your visitors, the only solution is to get an SSL certificate. SSL (Secure Sockets Layer) encrypts any information that a user enters on your site, such as credit card details, so that they cannot be stolen. You can tell if a site has an SSL certificate because its URL begins with https rather than http.

If your payment gateway is housed on a third-party website, such as PayPal, you need to ensure that this site has an SSL certificate and that the green padlock is displayed. - Make sure your gateway is compatible with your ecommerce plugin

The majority of WordPress websites use plugins such as WooCommerce or Paid Memberships Pro to create stores or membership sites. Not all these plugins, however, will operate with your preferred payment gateway. For UK businesses wanting to use a UK gateway, like WorldPay, you may need to purchase a WooCommerce extension to ensure your plugin and gateway are compatible. Make sure you check your plugin’s compatibility carefully before you sign up to a gateway. - You need a responsive gateway

The Centre for Retail Research estimates that by the end of 2017, 40% of all UK online sales will take place on a mobile device. That puts a value of £27 billion on UK mobile sales, a 26% increase on 2016 figures.

If you don’t want to miss out on 40% of the market, it is essential that your payment gateway is mobile friendly. You need to make it as easy as possible for mobile customers to pay for your goods or services. If the payment process is too difficult to complete on a small screen, your customers will go elsewhere. - Do you need your gateway configured for international trading?

If you sell on the internet, it is possible to have customers from all over the planet. If you intend to sell abroad, you need your payment gateway configured to accept different currencies and to display prices in the currency where a visitor is located. You also want the checkout instructions to be written in the language of the customer.

Before choosing a payment gateway, those seeking to sell to abroad should check that these services are available. - Recurring payments options

If you sell anything which requires a recurring payment, whether an annual membership or monthly subscription, then you need to set up an automated payment option on your payment gateway so that these can be collected on the due date. If you do this, remember to give your customers the option to automatically renew after the initial minimum contract period is over.

Make sure your gateway provider can enable recurring payments, if you require them. - Adding shipping fees and VAT

If you’re VAT registered or charge a shipping fee, you need to be able to add these to your final bill. To ensure this goes smoothly, you want your payment gateway to be able to calculate the VAT amount for you and offer a range of shipping options (you may charge more for specific locations or extra for quick delivery, etc.) Again, if you need these services, check that your gateway can provide them.

Conclusion

If you are intending to sell things via your WordPress website, hopefully this post will have given you an overview of all the things you need to consider when choosing the right payment gateway.

If you have a WordPress store or membership site and are looking for reliable and secure hosting for your online business, take a look at our dedicated WordPress hosting packages.